The Smart Move for Small Business: Group Health Insurance

If you’re running a small business and relying on individual health insurance for yourself or your employees, you should know there are some big changes ahead. Serious increases are coming soon, and they are expected to hit individual health insurance hard. The businesses that prepare now are going to be in much better shape than those that wait.

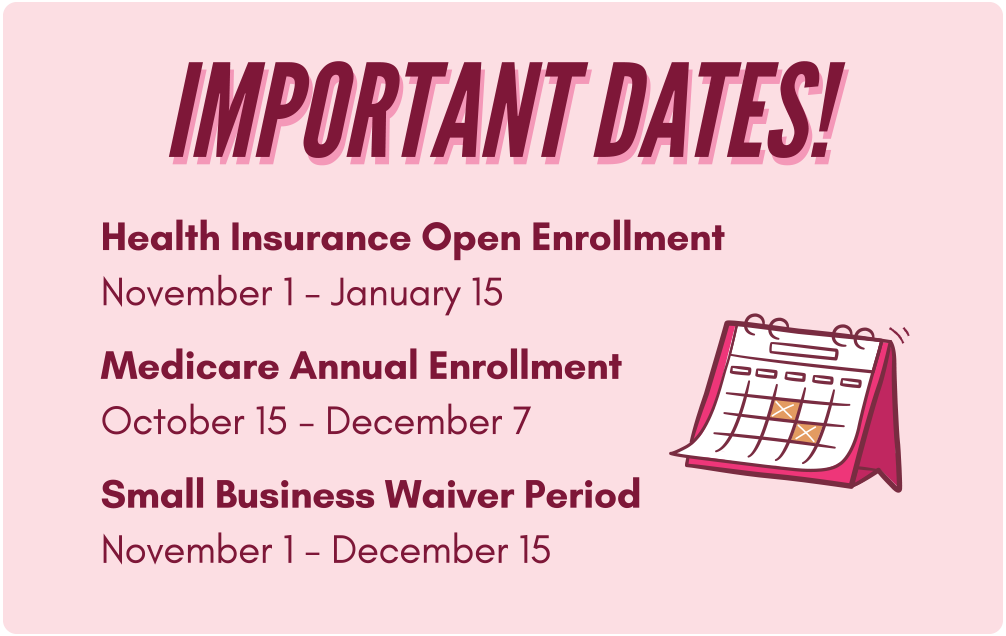

Annual insurance check-ups are always a good idea, but what’s headed our way in 2026 isn’t your typical year-over-year adjustment. The enhanced premium tax credits that have kept individual marketplace coverage affordable are set to expire December 31, 2025, and that’s not very far away. There is still time to get ahead of these increases, but you’ll need to act fast.

Why Group Insurance Makes Sense Now

Already, Utah’s individual market rates have jumped considerably. Stack that on top of the upcoming tax credit expiration, and people buying individual marketplace plans are looking at increases as high as 438% in what they’ll actually pay.

Already, Utah’s individual market rates have jumped considerably. Stack that on top of the upcoming tax credit expiration, and people buying individual marketplace plans are looking at increases as high as 438% in what they’ll actually pay.

Utah has a much stronger group market with better benefits than individual plans, and group plans typically cost less per person. And unlike individual plans that lock you into specific enrollment windows, you can start a group plan at any time — which means businesses can sign up any time of the year. That flexibility matters a lot right now.

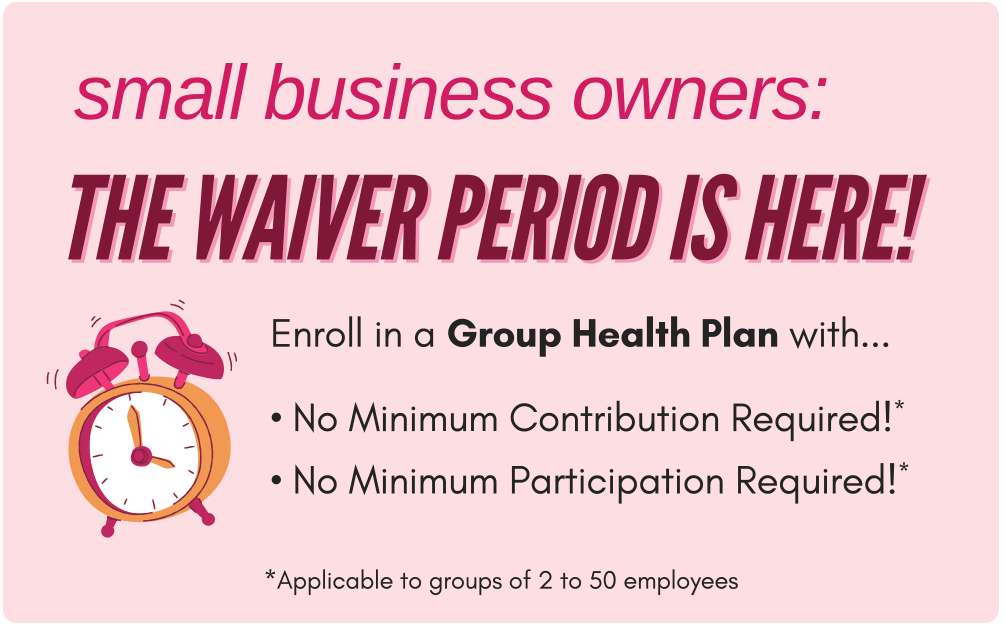

The Special Enrollment Window You Probably Don’t Know About

If you’re thinking about enrolling in group health insurance it’s a good idea to get it done sooner than later. A strategic window is closing soon, and it could potentially save you money. There is a small group Special Enrollment Period that runs November 15-December 15 each year, letting businesses start group coverage without the usual requirements.

During this window, you only need two eligible employees, and only one to enroll to get your group plan started, and you don’t have to contribute anything to premiums. You can get access to group rates and pay with pre-tax dollars.

How We Can Help

How We Can Help

The 2026 rate increases are fast approaching, but there is still time to navigate this transition smoothly. And if traditional group insurance just isn’t for you, there are other strategies we can explore — like Health Reimbursement Arrangements (HRAs).

Don’t wait until January 1, 2026, when individual premiums spike and you’re scrambling for solutions. Here at Ark Insurance, we’ve built a reputation on putting clients first, and we’re committed to finding the right plan for you and your employees. When you’re facing significant market changes like this one, having the right kind of expert on your side matters.

The window to lock in better rates is getting smaller. Get in touch with us today to explore your options.